A guide to keeping your business prepared

A guide to keeping your business prepared

What is e-invoicing?

E-invoicing is the process of generating invoices in a digital format, so you can issue and store them electronically. The Zakat, Tax and Customs Authority (ZATCA) in the Kingdom of Saudi Arabia (KSA) has rolled out regulations mandating businesses to adopt an e-invoicing process in two phases, starting on December 4, 2021.

For KSA VAT taxpayers, e-invoices will resemble the VAT tax invoices that are generally issued, but will be generated through an online system. Do note that a paper invoice that is copied or scanned is not considered an e-invoice.

Once issued, an e-invoice cannot be edited. However, you can issue electronic notes (debit and credit notes that are VAT compliant and issued through an electronic system). These should be issued with reference to the original invoice that was issued. For instance, if your buyer has returned your product, you cannot alter the original invoice, but you can issue a credit note through the e-invoicing system. All of your invoicing and note issuing transactions will have to be done through the same e-invoicing system, and must be compliant with ZATCA’s regulations. This standardizes the way transactions are made, ensuring that everything is done uniformly and information is stored securely.

You will have to issue e-invoices for sales made within the country, exports made from KSA to other countries, and goods and services for which you have received advanced payments. E-invoices are not required for supplies exempted from VAT and payments related to them, imports entering KSA, or supplies that are subject to reverse charge mechanism.

Why is e-invoicing being introduced?

These regulations are being rolled out so that businesses can work more efficiently and securely.

The ultimate goal of this move is to integrate your business data with the ZATCA system to make trade more seamless and transparent. The government can standardize the way invoices are reported to the system, with a common, machine-readable format, while also staying updated on the transactions that get pushed to their portal. Paper storage and hand-written invoices will be phased out and, since all invoices will be authenticated on the ZATCA portal, fraudulent activities such as fake invoices can be detected.

E-invoicing will also create a common database for audits. With this readily available information, tax authorities won’t need to conduct audits as frequently as before.

Other benefits of e-invoicing for taxpayers:

- A better experience for sellers and buyers. When you issue invoices quickly in real time, input tax credits will be processed faster.

- Electronic data will be more secure and less error-prone than paper entries. With a proper system for validating invoices, there will be fewer chances for fraud, leading to fair competition and improvement of trade.

- A streamlined electronic invoicing process reduces slip-ups and additional hassles for business owners. Your workload gets reduced, you get paid faster, and you can retrieve documents easily when storing them digitally.

To comply with the rules, it’s essential that every resident taxpayer is prepared for einvoicing. Here’s what you need to know about how the KSA VAT einvoicing regulations will impact you, and what you need to do in the future.

Guidelines for e-invoicing in KSA

- The e-invoicing provisions will apply to all taxable goods and services that are subject to VAT (whether standard or zero rate).

- All VAT-registered business owners (except non-resident taxable people) within KSA who make sales within and outside KSA have to adopt the e-invoicing process. If you are a third party in KSA issuing a tax invoice on behalf of a taxable person, you will have to adopt the e-invoicing process too. For instance, an accounting firm that issues invoices on behalf of a textile seller would be responsible for these regulations.

- E-invoicing is mandatory for all B2B, B2G, and B2C transactions. While issuing an e-invoice to a buyer, you should provide a printed copy as well.

- The invoices have to be in Arabic. You may opt to translate them or add another language, but it is mandatory to issue the e-invoice in Arabic.

The two phases of e-invoicing regulations in KSA

Phase 1 (December 4, 2021): Issuing and storing e-invoices

From this date, as a taxpayer, you will have to issue and store e-invoices and electronic notes instead of physical invoices, credit, and debit notes.

In phase 1, you will need to start using an e-invoicing system that has internet connectivity and is compliant with ZATCA. The e-invoicing system can be an online cash register, e-invoicing software installed on your computer, or a cloud-based e-invoicing solution.

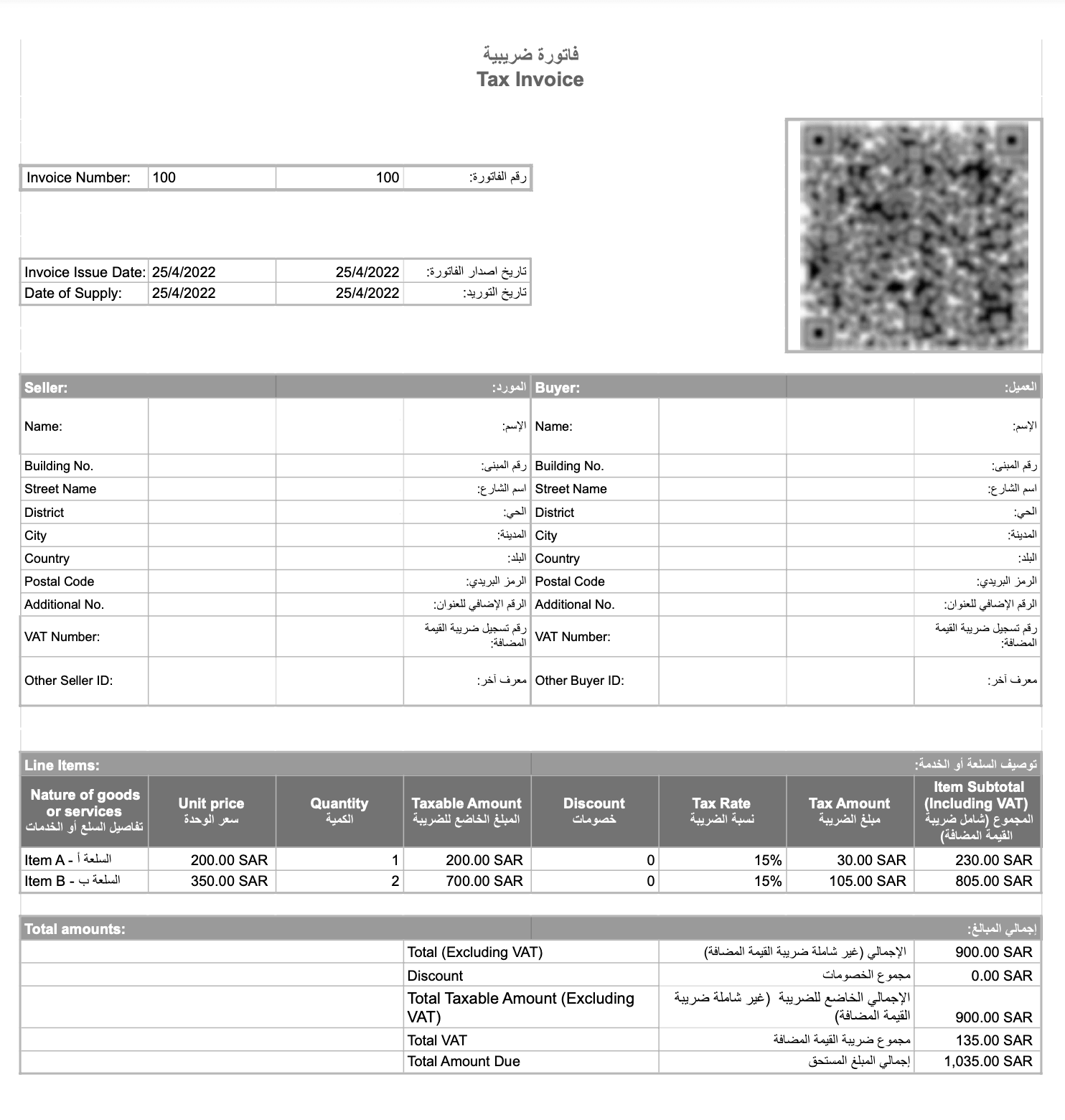

All elements and mandatory fields of the tax invoice must be included while issuing an e-invoice, such as the seller’s name and VAT registration number, the time the invoice is being issued, the VAT total, and the overall value of the invoice inclusive of VAT.

In phase 1, you don’t need to share data and report invoices to ZATCA.

Phase 2 (January 1, 2023): Integrating with the ZATCA system

This phase will be implemented in different stages for targeted taxpayer groups. Starting on January 1, 2023, you will have to integrate your e-invoicing solution with ZATCA’s system so you can send the e-invoices generated to the portal for verification and validation. Since this phase will be affecting different people at different times, you will be informed by ZATCA about the integration date at least 6 months before it affects you.

By this phase, you will need to issue e-invoices in specific formats (such as XML or PDF/A-3 format with embedded XML).

This phase will also have more technical requirements, so it’s best to have a system that has built-in compliance with ZATCA’s guidelines. Your system must be able to connect to external systems with APIs (Application Programming Interfaces), and generate a Universally Unique Identifier (UUID), a digital signature, a sequential number which differentiates each e-invoice, a hash, and a cryptographic stamp. Your system should also be equipped with anti-tampering features.

These features aren’t mandated for phase 1, but are necessary by phase 2.

Types of e-invoices

Tax e-invoice (Standard e-invoice)

Tax e-invoices are issued for B2B and B2G transactions, and are generally used for claiming input VAT deduction by buyers. In phase 1, these invoices will have to be shared with buyers in the required format. In phase 2, these invoices can be shared with buyers only after being cryptographically stamped and cleared by ZATCA.

If your buyer is VAT registered, you will have to add their VAT registration number to the invoice, and you can opt to add a QR code. Here is a sample e-invoice:

Source: ZATCA

Source: ZATCASimplified e-invoices

Simplified e-invoices are issued for B2C transactions at the point of sale. With such invoices, the buyer won’t need to use the invoice for input VAT deduction. If you are issuing a simplified tax invoice (B2C invoice), your e-invoicing system must generate a QR code with the invoice. This is important for validating your e-invoices.

In phase 1, all you will have to do is share the simplified e-invoices with your customers. However, in phase 2, these invoices will have to be reported to ZATCA within 24 hours of issuing them.

Both these e-invoices can also be self-billed (if approved by the tax authority) or billed by a third party. If the invoice is self-billed (billed by the buyer on your behalf), you will still be responsible for the accuracy of the e-invoice generated. An electronic marker will indicate whether the invoice is self-billed or billed by a third party.

Transaction type Type of e-invoice to be issued Taxable supplies valued at SAR 1,000 or more (issued to a taxable person or non-taxable legal person) Standard e-invoice Taxable supplies, excluding exports, valued at less than SAR 1,000 (issued to a taxable person or non-taxable legal person) Both (Standard e-invoice or Simplified e-invoice) Taxable supplies (excluding exports) issued to a non-taxable person Simplified e-invoice Zero-rated supplies valued at SAR 1,000 or more (issued to a taxable person or non-taxable legal person) Standard e-invoice Export of goods Standard e-invoice Intra-GCC supplies Standard e-invoice Nominal supplies (not presented to a customer, but kept for audit purposes) Standard e-invoice

How the e-invoicing process works in KSA

E-invoicing isn’t so different from the usual invoicing process. It’s essentially the same process but conducted in a more efficient and secure manner.

Here’s what you have to do for each transaction:

- Use a compliant e-invoicing system to generate the e-invoice with all the required fields.

- Issue a copy to the buyer. By phase 2, you will need to push this invoice to ZATCA’s portal and get it validated before you send it to the buyer.

- Store the e-invoice in your system for future reference. Moving to a cloud-based solution that offers you e-invoicing features will make storage easier and ensure compliance automatically.

Do’s and Don’ts for Taxpayers

Do’s

If you are a taxpayer in KSA, you have to select an e-invoicing system, or find an invoicing provider that can configure their system to offer e-invoicing solutions in compliance with ZATCA. Once you’ve selected a system and you know how to use it, test out the process before the enforcement date of December 4, 2021.

In most businesses, there may be more than one person handling accounts. Ensure that all of your invoicing staff are well-trained in using the e-invoicing system, so they can be prepared to run transactions smoothly. If you have developers and technical experts working with you, ask them to visit ZATCA’s website to stay up to date on all the technical and security requirements. A cloud accounting solution can make this process simpler by taking care of VAT compliance and keeping up with the latest changes in the regulations set by the government automatically, without giving you any additional work.

Don’ts

Once e-invoicing comes into effect, you cannot issue hand-written or manual invoices.

While you are looking for an e-invoicing system, avoid opting for a system that:

- Allows anonymous access.

- Has no user management capabilities.

- Permits e-invoices and associated notes to be edited or tampered with.

- Allows multiple e-invoice sequences to be created.

- Permits time changes or exporting the stamping key.

Avoid modifying invoices—instead, issue a debit/credit note and link it to the original invoice. Ensure you don’t delete any e-invoices once they’re issued, as they will be needed for future reference.